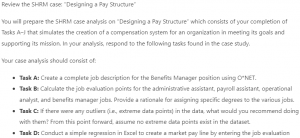

Review the SHRM case: “Designing a Pay Structure”

You will prepare the SHRM case analysis on “Designing a Pay Structure” which consists of your completion of Tasks A–J that simulates the creation of a compensation system for an organization in meeting its goals and supporting its mission. In your analysis, respond to the following tasks found in the case study.

Your case analysis should consist of:

- Task A: Create a complete job description for the Benefits Manager position using O*NET.

- Task B: Calculate the job evaluation points for the administrative assistant, payroll assistant, operational analyst, and benefits manager jobs. Provide a rationale for assigning specific degrees to the various jobs.

- Task C: If there were any outliers (i.e., extreme data points) in the data, what would you recommend doing with them? From this point forward, assume no extreme data points exist in the dataset.

- Task D: Conduct a simple regression in Excel to create a market pay line by entering the job evaluation points (on the X axis) and the respective weighted average market base pay (on the Y axis) for each benchmark job.

- Task E: What is your R squared (variance explained)? Is it sufficient to proceed?

- Task F: Calculate the predicted base pay for each benchmark job.

- Task G: Because your company wants to lead in base pay by 3 percent, adjust the predicted pay rates to determine the base pay rate you will offer for each benchmark job.

- Task H: Create pay grades by combining any benchmark jobs that are substantially comparable for pay purposes. Clearly label your pay grades and explain why you combined any benchmark jobs to form a grade.

- Task I: Use your answer to Task H to determine the pay range (i.e., minimum and maximum) for each pay grade.

- Task J: Given the pay structure you have generated, consider the following: Does this pay structure make good business sense? Do you think it is consistent with the organization’s business strategy? What are the implications of this pay structure for other HR systems, such as retention and recruiting?

- Your analysis of this case and your written submission should reflect an understanding of the critical issues of the case, integrating the material covered in the text, and present concise and well-reasoned justifications for the stance that you take. You are to complete this case analysis using Excel in a spreadsheet analysis format.

You may discuss your case analysis Assignment with the class, but you must submit your own original work.

Case analysis tips: Avoid common errors in case analyses, such as:

● Focusing too heavily on minor issues.

● Lamenting because of insufficient data in the case and ignoring creative alternatives.

● Rehashing of case data — you should assume the reader knows the case.

● Not appropriately evaluating the quality of the case’s data.

● Obscuring the quantitative analysis or making it difficult to understand.

Typical “minus (–)” grades result from submissions that:

● Are late.

● Are not well integrated and lack clarity.

● Do not address timing issues.

● Do not recognize the cost implications or are not practical.

● Get carried away with personal biases and are not pertinent to the key issues.

● Are not thoroughly proofread and corrected.

Make sure your document includes:

• Your name

• Date

• Course name and section number

• Unit number

• Case name

• Page numbers

The case analysis should contain Tasks A–J stated in the case. Check for correct spelling, grammar, punctuation, mechanics, and usage. Citations should be in APA style.

Here is the Assignment grading rubric.

Assignment submission: Before you submit your Assignment, you should save your work on your computer in a location that you will remember in Excel format. Save the document using the naming convention: Username_Unit4_Assignment.xlsx. Submit your file by selecting the Unit 4: Assignment Dropbox.

HELPFUL NOTE:

To My Students:

I just wanted to reach out in advance regarding the Unit 4 Assignment. The case study presented asks you to work through calculations for a pay structure involving 5 different positions. This is a pretty heavy set of tasks to accomplish in one week. Fortunately, I have been able to readjust this a bit so that the work load would be manageable in a week’s time.

FOR THE UNIT 4 ASSIGNMENT, YOU ONLY NEED TO CALCULATE FOR THE FRONT DESK RECEPTIONIST AND THE BENEFITS MANAGER POSITIONS. You do NOT have to calculate for the other 3 positions: Administrative Assistant, Payroll Assistant, Operations Analyst.

Additionally, since this involves math (and a little statistics), I have put together supportive material (see below) to help guide you through how to do this. PLEASE just follow the guidance below and you will be able to move through this easily.

PLEASE be sure to not wait until the last minute to do the Unit 4 Assignment. There’s a lot to it, so I don’t want anyone to be surprised.

I can’t provide a sample since that would contain the answers… But that’s okay, you can take this piece by piece..! PLEASE READ THESE DETAILS BELOW CAREFULLY. If you take it slowly, this goes pretty well. (And! If you get to the math portion below and you feel out of your element, PLEASE touch base with the Math Tutor (see separate announcement about Academic Support Centers for links). They offer wonderful assistance!

First, let’s take this steps..!

In Task A, you have to create one job description for the Benefits Manager. There are details in how to approach this and in the Appendix there are other job descriptions for the other positions so you can see how these should look. The case study provides suggestions about where to go to get info on this job description. So please read through those details for more guidance.

Next, in Task B, you will calculate the job evaluation points for positions. If you look just above the Task B item (on the previous page), you’ll see info and a sample of how to do this based on the receptionist position. Don’t forget to provide your rationale for the job evaluation points assigned. Use those same items as in the sample chart – Skills, Responsibility, Effort (and their subcategories). You can change up the percentages these are worth as you see fit for each job… Please be sure to remember that you have to take into consideration what would be required for each of the elements in the job evaluation – again read the sample that gets you started. For instance, in the education area, please remember that the weight would be more for a job that needs a Bachelor’s degree rather than a high school diploma/GED. Please also be sure that you multiple the Degree times the Weight to get the Points for each line (far right item). Then total that Points column at the bottom. This needs to be done for each Benchmark job. And each one should have a different Points total as they have different requirements from each other.

And in Task C, here’s a little further help/guidance with regard to completing this. The first part deals with what to do with outliers. That would require you to address this via text in your document. (Again your readings will support this, and you can also do more research online if you’d like. Don’t forget to use supporting citations when you can – these strengthen your academic work..!)

The second part deals with calculating weighted means. (This isn’t as bad as it sounds – I promise..!)

Weighted means of base pay should be calculated for each benchmark job from the survey data. Weighted means, as compared to simple means, are calculated to better represent the market data (Milkovich & Newman, 2008). A simple mean would be calculated by adding up the average base pay rates and dividing by the number of organizations (six in this case); but small and large companies would both be given the same weight if using a simple mean. A weighted mean gives equal weight to each job incumbent’s wage and thus is more representative of the data. For example:

Mean # of employees

Co. A 30,000 2

Co. B 15,000 10

The simple mean salary is $22,500.

[(30000 + 15000) / 2 = 22500]

But the weighted mean salary is $17,500.

[(2/12 * 30000) + (10/12 * 15000) = 17500]

For each position, you take the number of employees in Co. A, which is 2. Divide that into the total number of employees in all companies, which is 12. Or 2/12… Which equals 0.16667.

Then multiply that by the mean salary in Co. A, which is $30,000.

So, 30,000 times 0.16667 equals 5,000.

Then for the next company, Co. B, you do the same with those numbers. You take the number of employees in Co. B, which is 10. Divide that into the total number of employees in all companies, which is 12. Or 10/12… Which equals 0.833333.

Then multiply that by the mean salary in Co. B, which is $15,000.

So, 15,000 times 0. 0.833333 equals 12,500.

Then you take the $5,000 from the first company and the $12,500 from the second company and add them together to get the $17,500 weighted means.

—————————–

Do this for the Front Desk Receptionist and the Benefits Manager companies.

For Task D, you are asked to do some statistics with a regression analysis. Don’t worry..! Keep reading and you will see a link to an online calculator that can help you with this! 😉

Regression analysis is “the statistical tool for the investigation of the relationship between variables” (Sykes n.d.). It is used when data is analyzed to determine the causal effect of one variable upon another variable. For example, the effect of the increased cost of a gallon/litre of gasoline/petrol on the demand for that product is determined via “regression analysis”.

If you want to do the regression analysis calculation in Excel (rather than using the online calculator link that is below), you can go to:

http://www.law.uchicago.edu/files/files/20.Sykes_.Regression.pdf – here you will find the article “An introduction to Regression Analysis” by Dr. Alan Sykes that may help you understand regression analysis more clearly and help you in answering the discussion questions below.

Video for how to run the regression analysis in Excel:

http://www.wikihow.com/Run-Regression-Analysis-in-Microsoft-Excel

NOTE: I have Excel 2010, so getting the Regression Toolpak added in was easy. You may have to add this Excel Analysis Toolpak in – no matter what version of Excel you may have. Here is link to how to add that toolpak, for the various Excel versions:

AND FINALLY, IF YOU WANT TO JUST USE AN ONLINE SIMPLE REGRESSION CALCULATOR FOR TASKS D AND E (GETTING THE R SQUARED NUMBER BUT STILL YOU HAVE TO ANSWER THE QUESTION IN TASK E AS WELL…) (AND SKIP USING EXCEL), YOU CAN GO HERE:

http://www.graphpad.com/quickcalcs/linear1/

Here you would plug in your Job Evaluation Points for each position in Task B (under the X column), and also the corresponding weighted average salary for each position in Task C (under the Y column). It would look something like this:

Regression Analysis

Job Evaluation Weighted

Points Avg. $

X Y

Recept. 120 19944.44

Admin Asst. 145 29458.33

Pay Asst. 175 34000

Ops Analyst 215 56875

Ben Mgr. 245 62900

NOTE: THE JOB EVALUATION POINTS YOU HAVE WILL BE DIFFERENT FROM THE EXAMPLE ABOVE. EVERYONE WILL HAVE SLIGHTLY DIFFERENT POINT VALUES, AND THAT IS PERFECTLY OKAY. THE WEIGHTED AVERAGE SALARIES THOUGH MUST MATCH THE ONES IN THIS EXAMPLE. SO IF YOU DIDN’T QUITE GET THE ANSWERS RIGHT FOR TASK C, PLEASE GO AHEAD AND USE THESE WEIGHTED AVERAGE SALARY FIGURES.

Once you run your simple regression through the calculator link (http://www.graphpad.com/quickcalcs/linear1/), you will get results that will look something like this (yours will be different since everyone will have different job evaluation points that they created in Task B – again, that’s perfectly okay):

Best-fit values

Slope

360.33 ± 36.29

Y-intercept

-24324.19 ± 6737

X-intercept

66.31

1/Slope

0.002798

95% Confidence Intervals

Slope

241.9 to 472.9

Y-intercept

-45137 to -2262

X-intercept

9.211 to 96.90

Goodness of Fit

R square

0.9700

Sy.x

3683

Is slope significantly non-zero?

F

96.99

DFn,DFd

1,3

P Value

0.0022

Deviation from horizontal?

Significant

Data

Number of XY pairs

5

Equation

Y = 360.33*X – 24324.19

**************

Note: I’ve gone through this material and it really does provide useful info that can basically hold your hand through this process. So I encourage you to take a look and follow along – I hope it you find this helpful! (I really think you will!)

Now, let’s focus on the next bit to get you started..! The first item that Task D asks for is: Identify the slope and y-intercept and write the equation for the market pay line.

Regression creates a “line of best fit” by merging the job evaluation points (X) and the external salary data (Y). The resulting regression line is used to predict the base pay (Y) for a specific number of job evaluation points (X). The equation for the simple regression line (as it is for any line) can be represented as: y=mx+b; in which:

y =the predicted base pay

m =the slope of the line

x =the job evaluation points

b =the y-intercept

So, for example, if the regression results show that m = 400 and b is -20000, then the equation is y=400(x) – 20000 and the predicted pay rate for a job assigned 100 points would be y= 400(100)-20000, or $20,000.

The regression output will also show information about how good the regression line fits the data. Specifically, look at the “R squared” in the regression output. Generally, the R squared, referred to as variance explained, should be .95 or higher. If R squared is significantly lower than this, there may be problems stemming from the job evaluation step. For example, the points assigned to certain benchmark jobs may be off – i.e., not make sense given the level of tasks, duties and responsibilities required for the job and the knowledge, skills and abilities needed by the job incumbent. If this is the case, re-examine the job descriptions and reconsider the points assigned to the benchmark jobs. Alternatively, there may be errors in the weighted average calculations. After conducting the regression again, examine the new R squared.

To calculate the slope of the market pay line, look in the Excel regression output for the “Coefficient of the X Variable.” The y-intercept is located in the regression output as the “Coefficient of the Intercept.” Be sure to write out the regression equation appropriately. Here’s an example:

Y = m(x)+b

Y = 360.33(x) -24324.19

This means that each job evaluation point is worth $360.33 based on the figures I used. PLEASE remember that everyone will have different figures based on how they planned their job evaluation points. And that’s fine..! It’s perfectly okay for different people to have different numbers for this.

For Task E, the sample R squared from above is .9699 (or .97 when rounded up). The description below tells you about R squared and how to interpret it:

R-squared is a statistical measure of how close the data are to the fitted regression line. It is also known as the coefficient of determination, or the coefficient of multiple determination for multiple regression.

The definition of R-squared is fairly straight-forward; it is the percentage of the response variable variation that is explained by a linear model. Or:

R-squared = Explained variation / Total variation

R-squared is always between 0 and 100%:

- 0% indicates that the model explains none of the variability of the response data around its mean.

- 100% indicates that the model explains all the variability of the response data around its mean.

Please check your R-squared to proceed with your response.

——————————————-

PLEASE BE SURE TO ANSWER TASK E’S QUESTION: What is the R squared? And is it sufficient to proceed?

For Task F:

Let’s have you do the basic math:

Here’s the formula to use: y=mx+b, where x is the job evaluation points, b is the y-intercept, and m is the slope coefficient from the regression. So you can use this formula:

Y = 360.33(x) -24324.19

as the predicted base pay for each job.

Just insert for (x), the job evaluation point number that you created in Task B. Each job evaluation point number will be different, so you’ll get a different output for each position.

So your calculations would be:

-Y = 360.33 times (the job evaluation point number that you created in Task B for the receptionist) minus 24324.19 (Note: Y would be the answer to the calculations above…)

-Y = 360.33 times (the job evaluation point number that you created in Task B for the benefits manager) minus 24324.19 (Note: Y would be the answer to the calculations above…)

Then for Task G, you take each of the answers for Task F, and increase them by 3% (as the case states the policy will be to lead base pay by 3%).

Your calculation would be:

-Take your answer for the receptionist in Task F, and multiply it by 1.03.

-Take your answer for the business manager in Task F, and multiply it by 1.03.

For Task H, you create pay grades for the job, put them in the grades, and be sure to explain what each pay grade represents and why you put the positions into those grades. No calculations are needed here. You can select 2 pay grades (you can name them A, B, or 1, 2,… or whatever you would like). Then based on the predicted pay that you just did, and taking into consideration the skills required, place these into the necessary pay grade and provide a rationale as to why you you put that job there. (Everyone may end up with a slightly different answer to this item, and that’s fine!)

For Task I, you’ll show the minimum and maximum for each pay grade. You’ll use the pay figures for the positions from Task H here to show these. So if you have 2 positions in one pay grade – the lower position would be the minimum… The higher one would be the maximum. Then calculate the average for the two positions. (Add them together, and divide by 2 for the average.) Note: If you have just one position in a pay grade, then you just have the one pay for an average and that’s it…

Then finally, apply the percent guidelines provided in the case to determine the pay ranges. So if the case calls for 10% above and below the midpoint, calculate as follows:

Take the minimum pay, and multiply by 1.10. Take the maximum pay, and multiply by 1.10. (If you only have one position in a pay grade, take that pay and multiply by 1.10 (which is 10% above) and then multiply again with that same pay and this time multiply by .90 (which is 10% below the midpoint). Now you’ve created minimums and maximums as defined by the case for each pay grade..!

And for Task J, please just answer the questions..!

I think that should give you a basic guide through the assignment. I hope this is helpful, and I look forward to reading your work!

Okay, you can breathe now… (Really, this is NOT bad… I just know how folks who are math-phobic can worry, so I wanted to walk you through this..!)

Again, since this may take some folks some extra time/effort, it might not be bad to set aside time to start working on this ahead of time… Hint, Hint, Hint… 😉

Dr. Sue