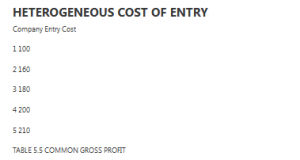

HETEROGENEOUS COST OF ENTRY

Company Entry Cost

1 100

2 160

3 180

4 200

5 210

TABLE 5.5 COMMON GROSS PROFIT

Number of Profit per Total Industry Companies Company Profit

1 1,000 1,000

2 400 800

3 250 750

4 150 600

5 100 500

TABLE 5.6 PAYOFF TO A COMPANY FROM ENTRY

Number of Other Companies that Enter

Company 0 1 2 3 4

1 900 300 150 50 0

2 840 240 90 �10 �60

3 820 220 70 �30 �80

4 800 200 50 �50 �100

5 790 190 40 �60 �110

5.3 Asymmetric Games 133

four other companies enter. For each of the other companies, enter is the best reply when two or fewer companies enter, but do not enter is the best reply when three or four other companies enter. Thus, for each company, ei- ther strategy is a best reply for some strategy configuration of the other four companies.

Let’s find the set of Nash equilibria. Rather than consider a particular strat- egy profile, suppose we start by thinking about how many entrants there will be at a Nash equilibrium:

■ Is there a Nash equilibrium with no entrants? No, because the gross profit for the first entrant is 1,000 and that exceeds all companies’ entry costs. Thus, if all of the other companies chose do not enter, then enter would be optimal for a company. Hence, it cannot be a Nash equilibrium for all companies to choose do not enter.