| Assessment 2 Part 3: Analysis of Overhead Using a Predetermined Rate |

| Scenario: |

| Atchison Company uses a job costing accounting system for its production costs. The company uses a predetermined overhead rate based on direct labor-hours to apply overhead to individual jobs. The company prepared an estimate of overhead costs at different volumes for the current year as follows: |

| Direct labor-hours |

150,000 |

180,000 |

210,000 |

| Variable overhead costs |

$1,155,000.00 |

$1,386,000.00 |

$1,617,000.00 |

| Fixed overhead costs |

712,800 |

712,800 |

712,800 |

| Total overhead |

$1,867,800.00 |

$2,098,800.00 |

$2,329,800.00 |

| The expected volume is 180,000 direct labor-hours for the entire year. The following information is for September, when Jobs 6023 and 6024 were completed: |

| Inventories, September 1 |

| Materials and supplies |

$ 31,500 |

| Work in process (Job 6023) |

$162,000 |

| Finished goods |

$337,500 |

| Purchases of materials and supplies |

| Materials |

$445,500 |

| Supplies |

$ 49,500 |

| Materials and supplies requisitioned for production |

| Job 6023 |

$148,500 |

| Job 6024 |

123,750 |

| Job 6025 |

84,150 |

| Supplies |

19,800 |

|

$376,200 |

| Factory direct labor-hours (DLH) |

| Job 6023 |

10,500 DLH |

| Job 6024 |

9,000 DLH |

| Job 6025 |

6,000 DLH |

| Labor costs |

| Direct labor wages (all hours @ $9) |

$229,500 |

| Indirect labor wages (12,000 hours) |

51,000 |

| Supervisory salaries |

118,800 |

| Building occupancy costs (heat, light, depreciation, etc.) |

| Factory facilities |

$21,450 |

| Sales and administrative offices |

8,250 |

| Factory equipment costs |

| Power |

13,200 |

| Repairs and maintenance |

4,950 |

| Other |

8,250 |

|

$26,400 |

| REQUIRED |

| Answer the following questions: |

|

|

|

Answers |

| 1. Compute the predetermined overhead rate (combined fixed and variable) to be used to apply overhead to individual jobs during the year. (Note: Regardless of your answer to requirement [1], assume that the predetermined overhead rate is $10 per direct labor-hour. Use this amount in answering requirements [2] through [5].) |

| 2. Compute the total cost of Job 6023 when it is finished. |

| 3. How much of factory overhead cost was applied to Job 6025 during September? |

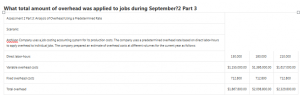

| 4. What total amount of overhead was applied to jobs during September? |

| 5. Compute actual factory overhead incurred during September. |

| 6. At the end of the year, Atchison Company had the following account balances: |

| Overapplied Overhead |

$ 3,300 |

| Cost of Goods Sold |

3,234,000 |

| Work-in-Process Inventory |

125,400 |

| Finished Goods Inventory |

270,600 |

| How would you recommend treating the over applied overhead, assuming that it is not material? Show the new account balances in the following table: |

| Overapplied Overhead |

| Cost of Goods Sold |

| Work-in-Process Inventory |

| Finished Goods Inventory

|